This article is an excerpt from a keynote address by Mr. Oluseyi Oyebisi, Executive Director, NNGO during his session at the 2024 CivicTech Innovation Network Capacity Building Training.

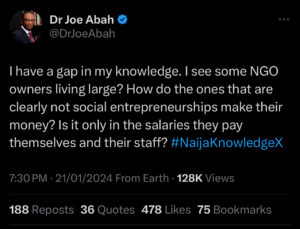

Dr Joe Abah’s Tweet on the 21st of January 2024 raised a lot of questions on regulatory compliances for NGOS and how NGO founders who are social entrepreneurs have the means to live large regardless of their duty to make impact and change the life of members of their community.

This tweet and the responses from the public was the opening glee for Mr Oyebisi’s session during the CTIN training as the participants engaged in a discussion about the reality in the NGO scheme and the regulatory compliances put in place to ensure accountability of Non governmental organisation in Nigeria.

This tweet and the responses from the public was the opening glee for Mr Oyebisi’s session during the CTIN training as the participants engaged in a discussion about the reality in the NGO scheme and the regulatory compliances put in place to ensure accountability of Non governmental organisation in Nigeria.

Hence, the essential character of a nonprofit is that it is Voluntary (matter of choice for founders and those belonging to them), Self-governing (Not under the direction of public authorities), and has no No Profit as the principle objective is not to generate profits from the activities they undertake.

And as such, there is no law in Nigeria that stops an individual from starting up a Nonprofit organisation as there is Freedom of Association as guaranteed by the Nigerian Constitution.

However, the moment a Nonprofit decides to register as incorporated to enable it open a bank account in the organisation’s name, have a Tax exemption status, apply for funds from donor or become a legal entity, under Corporate Affairs Commission or any other bodies in Nigeria, that organization is required to comply by all rules and requirement that govern such bodies.

This requirement includes Cash transaction report every six months by the organisation as required by SCUML, Annual Returns auditing by Federal inland revenue service (FIRS) and other laws under the Civil Society Regulatory Framework in Nigeria

By doing this, the Non-profit organisation will be accountable for every of its actions and inaction and stay transparent to the public. Hence, such questioning by individuals like Dr Joe Abah will not come to place. Putting in mind that Nonprofit organisations are not prone to funds and grants by local and international organisations which allows them to function well and have enough to pay people working for them.

Remember, that compliance isn’t just about meeting legal requirements; it is about building a foundation for sustainable growth and positive impact. By staying informed, proactive, and committed to ethical practices, startups and NGOs in Nigeria can navigate the regulatory landscape successfully.

Therefore, Navigating through the dynamic landscape of NGOs in Nigeria is understanding and adhering to regulatory compliance as paramount for sustained success. Whether you’re a building startup or a passionate NGO, it is important to understand key organisation policies which includes:

- Constitution

- Board Policy

- Conflict of Interest

- Human resources

- Financial resources

- Gender and social inclusion

- Communications

- Fraud and Anti-corruption Policy

- Anti-Money Laundering (AML), Combating and Financing of Terrorism (CFT)

- Privacy

In conclusion, Regulatory Compliance forms the bedrock of a thriving and impactful startup or NGO in Nigeria. By navigating the legal terrain, adhering to tax obligations, ensuring data protection, and embracing transparency, organisations can build a solid foundation for sustainable growth and positive change.